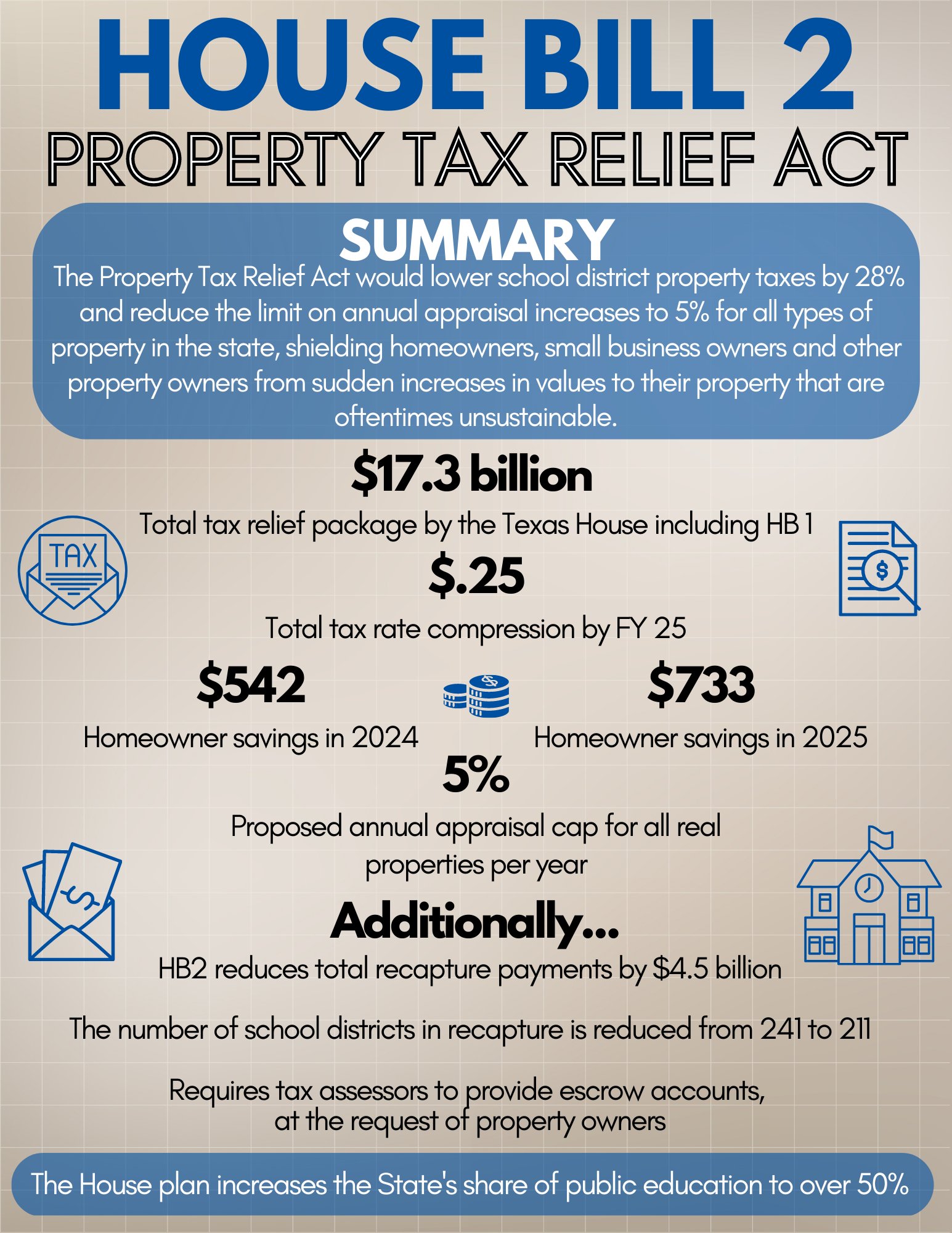

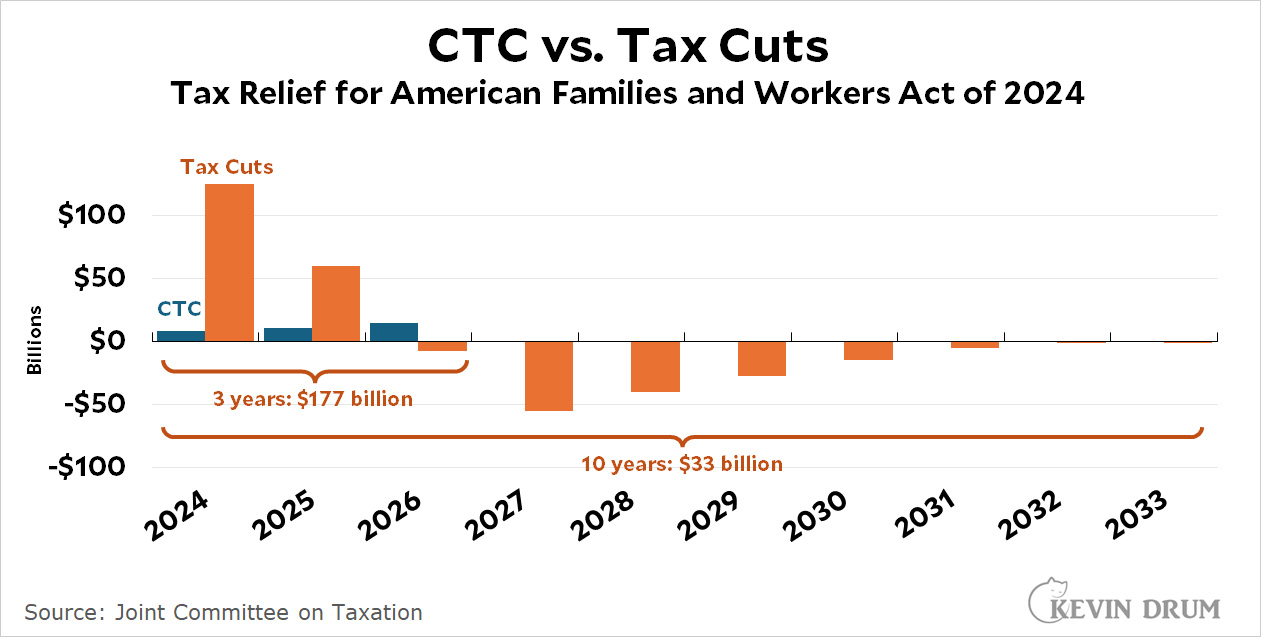

Taxpayer Relief Act 2025 – Low-income parents stand to benefit the most from proposed Child Tax Credit increases for the 2023 tax season — and their savings could add up to thousands depending on how many children they have. . A roughly $80 billion tax package under consideration in the US Congress includes an expansion of the child tax credit — a mechanism by which American families reduce the federal taxes they owe. The .

Taxpayer Relief Act 2025

Source : twitter.com

N.J. is ‘worth fighting for,’ Steve Sweeney says in announcing bid

Source : newjerseymonitor.com

5389.png

Source : uscode.house.gov

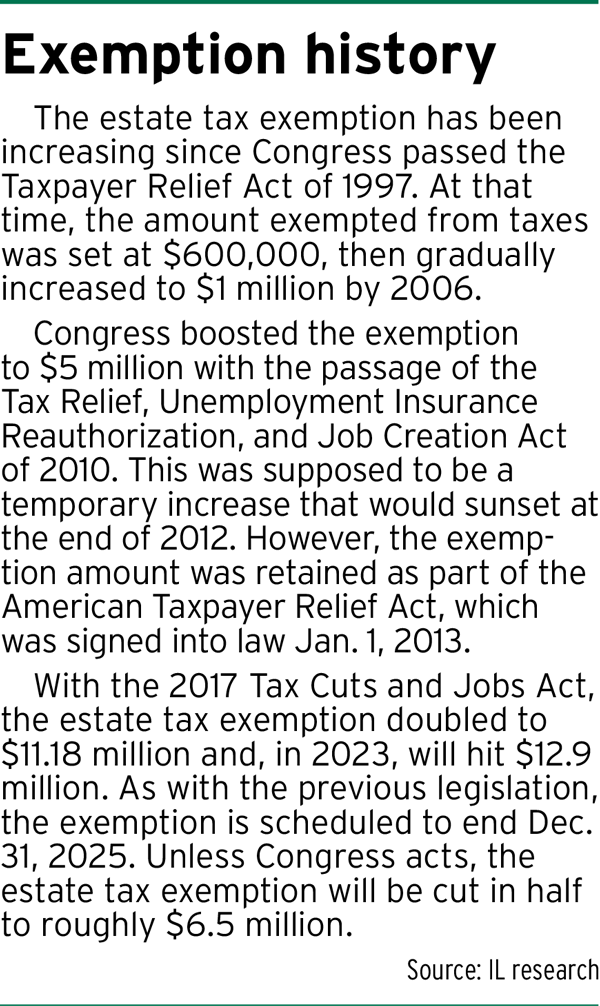

Ferocious rate’ of gifting as sunset nears for exemption: Transfer

Source : www.theindianalawyer.com

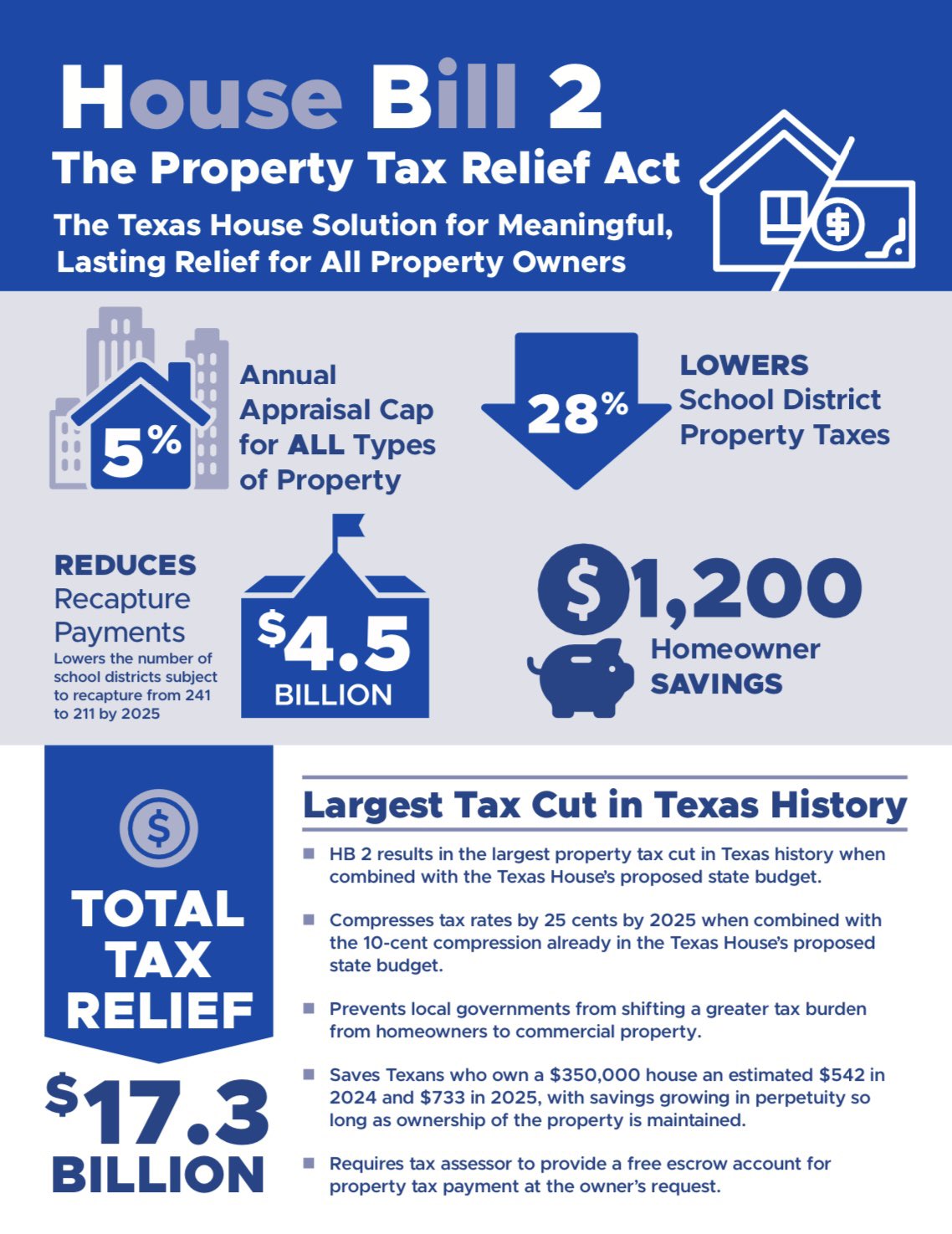

Dade Phelan on X: “Proud of the TX House today for overwhelmingly

Source : twitter.com

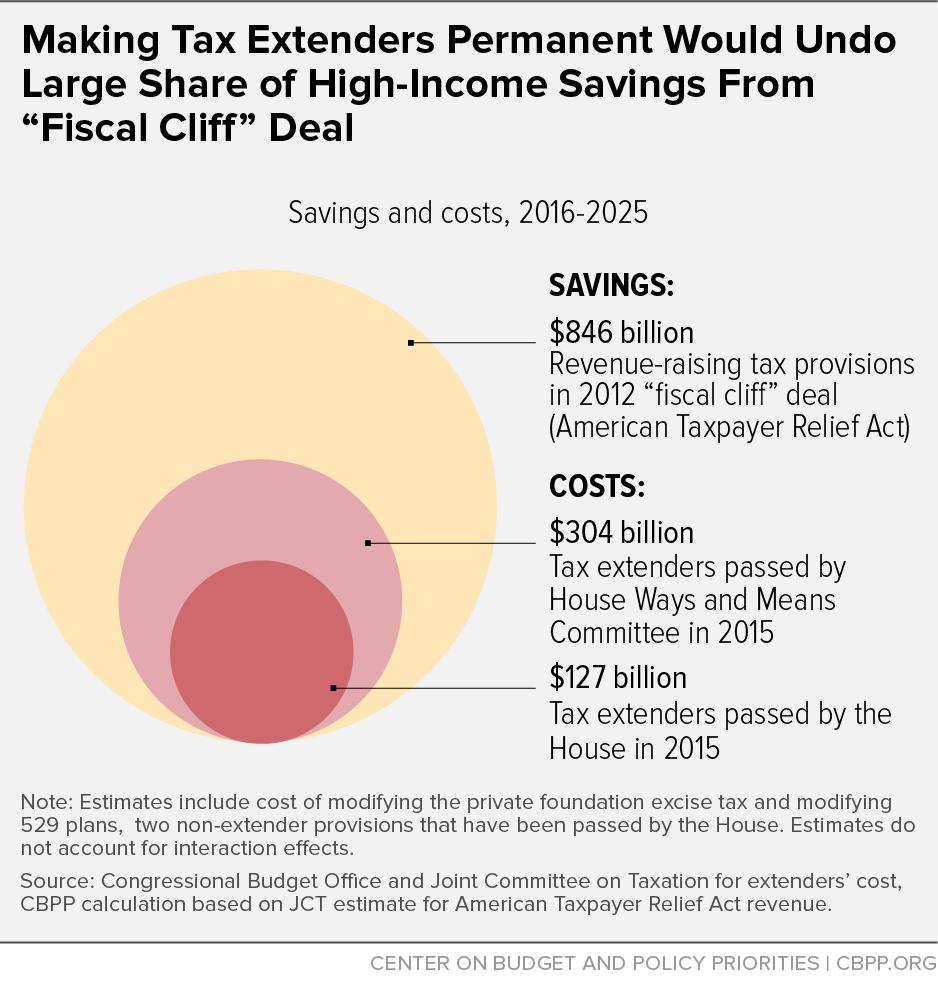

Making Tax Extenders Permanent Would Undo Large Share of High

Source : www.cbpp.org

Judy Chu on X: “DC’s enjoying a ❄️ day, but I’m busy working w

Source : twitter.com

comprehensive way FasterCapital

Source : fastercapital.com

TCJA: What to Know Before the Sun Sets | RGWM Insights

Source : rgwealth.com

Maybe that Child Tax Credit bill isn’t so great after all – Kevin Drum

Source : jabberwocking.com

Taxpayer Relief Act 2025 Texas House Republican Caucus on X: “????FLOOR UPDATE???? The House : Because of the portability provisions made permanent in 2013 by the American Taxpayer Relief Act of 2012, the surviving spouse may amounts and the GST tax exemption sunsets at the end of 2025. On . Most taxpayers have likely received a solicitation recently claiming that they may be entitled to thousands of dollars in employee retention tax credits. .